Effortlessly track and accept payments on-the-go with Tap to Pay

Managing payments is one of the biggest challenges for business owners, but with Tidy’s Tap to Pay, tracking payments and getting paid on time has never been simpler. Whether you’re a tradesperson, freelancer, or small business owner, Tidy’s mobile payment solution offers a fast, secure way to handle payments and track your earnings – all in one app.

With Tap to Pay, you can take in-person payments directly from your phone, eliminating the need for bulky hardware or long-term contracts. Tidy makes it easy to set up and receive payments instantly, keeping your cash flow steady and your business running smoothly.

How Tidy makes tracking payments simple with Tap to Pay

1. Quick and easy payment tracking

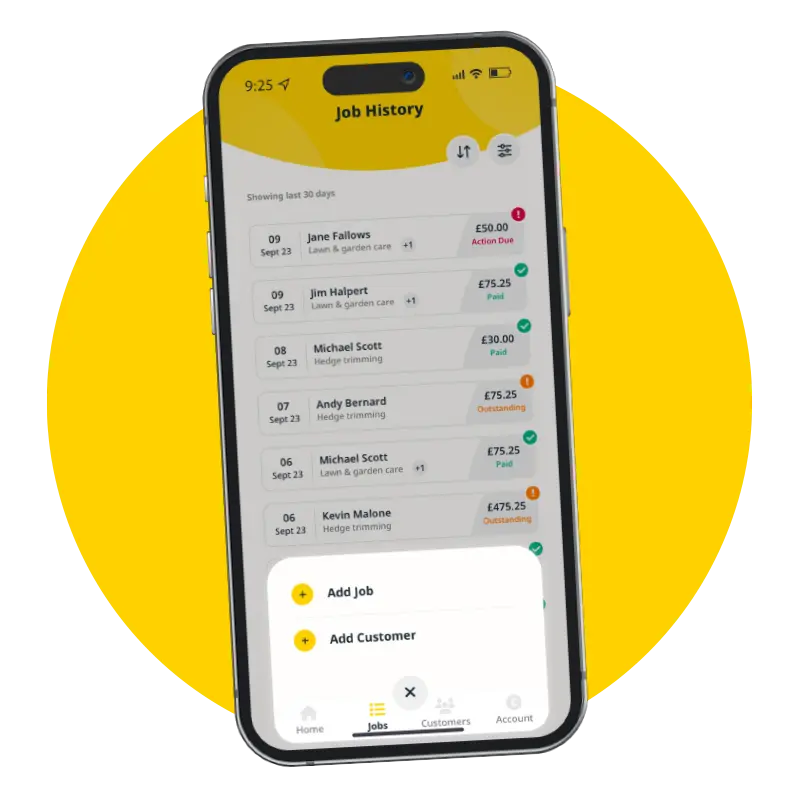

Tidy’s integration with Tap to Pay allows you to track payments in real time. With every transaction, your earnings are updated immediately, providing a live overview of what you’ve earned, what’s paid, and what’s still outstanding. No more waiting for a bank transfer or manually entering payments.

2. Instant transactions for faster cashflow

With Tap to Pay, payments are processed instantly, which means money is transferred to your account quickly. Once you’re an established user, Stripe ensures faster payouts, improving your cash flow and helping you stay on top of your finances. Tracking payments has never been easier, as all transaction data is automatically recorded in Tidy for easy access.

3. Simplified Payment Process

Setting up Tap to Pay is straightforward with Tidy’s step-by-step guide. In just 20 minutes, you’ll be ready to start accepting mobile payments with ease. Whether you’re at a client’s home, at a job site, or on the go, you can collect and track payments without needing additional hardware or complicated systems.

Benefits of using Tap to Pay for tracking payments

1. No more hardware or contracts

Tidy’s Tap to Pay feature eliminates the need for expensive card readers and long-term contracts. You can start accepting payments with just your smartphone, streamlining the process and reducing costs.

2. Track payments from anywhere

With mobile payment options like Apple Tap to Pay and Google Pay, you can accept payments on the go from your phone. Whether you’re at a job site or meeting with a client, tracking payments has never been more convenient.

3. Secure and fast transactions

Tidy ensures that all transactions processed through Tap to Pay are encrypted, safeguarding both you and your customers from fraud. With secure payment tracking, you can rest easy knowing that your business and financial data are protected.

4. Flexible payment options

Tap to Pay also offers customers the option to pay in instalments through Klarna, giving your clients more flexibility and increasing the likelihood of on-time payments. Offering this option can also improve your business’s competitive edge.

5. Digital receipts and reports

One of the key advantages of Tap to Pay is the ability to generate digital receipts and financial reports automatically. This reduces paperwork, improves your record-keeping, and helps you stay organised when it’s time for tax reporting or financial planning.

Get started with Tap to Pay and track payments seamlessly

STEP 1

Download the Tidy App

Simply download the Tidy app and log in with our magic link – no passwords required.

STEP 2

Set up in minutes

STEP 3

Start tracking payments

Begin adding customers, creating jobs, and accepting payments. Your earnings will be automatically tracked, and Tidy will keep an eye on what’s due and what’s been paid. It’s quick and hassle-free!

Why choose Tidy for tracking payments?

Benefits of digital invoicing:

- Track payments in real time: See your earnings and outstanding payments instantly.

- Accept payments anywhere: Use Apple Tap to Pay or Google Pay to accept payments with your smartphone.

- Boost cashflow: With faster payment processing, you’ll get paid quickly, keeping your cash flow steady.

- Improve efficiency: Tidy simplifies your payment process, reduces paperwork, and enhances your customer experience.