Why tracking payments matters for your business

Cashflow management is one of the biggest challenges facing small businesses and self-employed individuals. Late payments, missed invoices, and fluctuating incomes can put a significant strain on your ability to cover expenses, keep operations running smoothly, and plan for the future. In fact, cashflow problems are a leading cause of business failure.

Tracking payments effectively can prevent these issues, allowing you to:

- Avoid missed payments and delays

- Manage your finances more efficiently

- Improve cashflow predictability

- Reduce stress and improve mental well-being

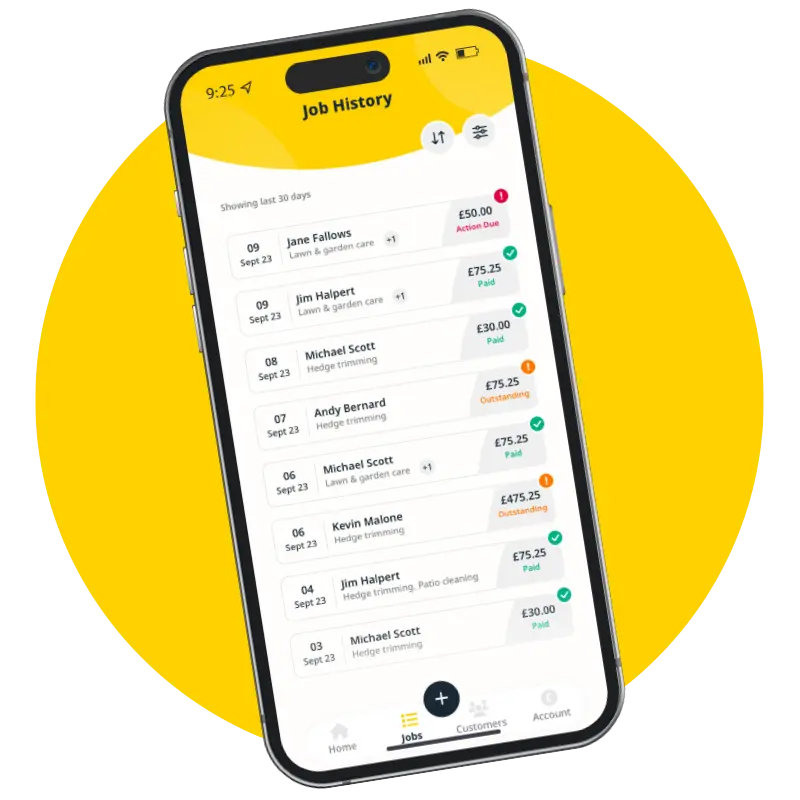

With Tidy’s intuitive platform, you can stay on top of your finances without the hassle. Tidy helps you visualise your total earnings, track overdue payments, and send reminders, so you can stay in control of your cashflow.

How Tidy simplifies payment tracking

1. Visualise your earnings

With Tidy, you can see at a glance how much you’ve earned, what payments are due, and what’s overdue. The easy-to-read dashboard helps you track payments in real time, giving you a clear overview of your financial situation.

2. Track overdue payments and stay on top of invoices

Tidy automatically reminds you when payments are due and prompts you to request payments that are overdue. This proactive approach helps you avoid cashflow disruptions and ensures timely payments.

3. Streamline payment requests

Send professional, branded invoices directly to your clients with integrated payment links. Whether you accept payments online or in person, Tidy offers secure and efficient ways to collect payments quickly.

4. Multiple payment options

Tidy gives you flexibility in how you receive payments. Use QR codes, Tap to Pay, or online payment links to easily collect payments both in-person and remotely.

Key benefits of tracking payments with Tidy

- Stay organised: Easily manage your invoices, outstanding payments, and overdue amounts in one place.

- Improve efficiency: Tidy’s payment reminders help you stay on top of your cashflow, reducing time spent chasing payments.

- Boost revenue: By streamlining your payment processes, Tidy helps ensure you get paid faster and more consistently.

- Enhanced customer experience: Offering seamless payment options improves the customer experience and enhances your business’s professional image.

Why choose Tidy for tracking payments?

Tidy is designed to help businesses and freelancers keep their cashflow on track, with easy-to-use tools and a simple interface. Whether you’re managing a few clients or a large portfolio of projects, Tidy gives you the tools to stay organized, increase efficiency, and improve your financial health.

Take control of your business finances today

Get Tidy and start tracking payments like a pro. With Tidy’s secure payment features, intuitive reminders, and real-time financial tracking, you can finally take control of your cashflow and focus on what matters most: growing your business.

By tracking payments with Tidy, you can prevent cashflow issues that often lead to financial stress. Tidy helps you to stay organised, streamline your payment process, and manage your business finances more effectively. With features that prompt you to create invoices, request and chase payments with flexible payment options, Tidy is your all-in-one solution for mastering your cashflow.